Microsoft Great Plains Fixed Assets Short Guide

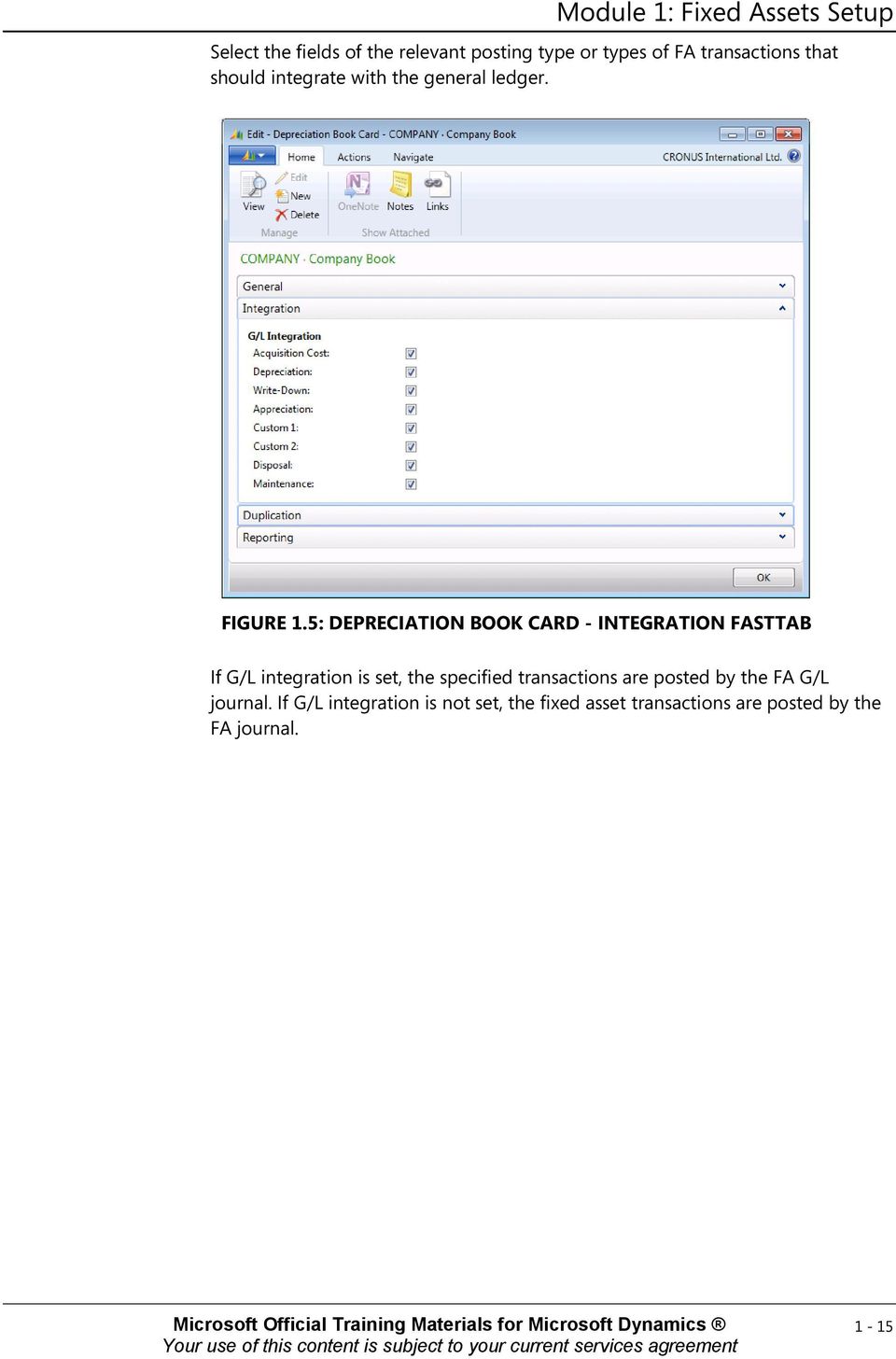

. in: As your company grows and you acquire more assets, it becomes increasingly more important to keep track of everything. Some methods are better than others, but the one software that has been receiving virtually unanimous praise from customers around the world is Microsoft Dynamics GP, a mid-market enterprise resource planning software solution, which was first announced by Microsoft after they acquired Great Plains Software in 2001. Main Features and Advantages of the Fixed Asset Management Module in Dynamics GP Manual record-keeping can greatly compromise the accuracy of your asset records. To avoid this, you need proper tools to easily manage new assets and keep track of existing ones. If you’re using Microsoft Dynamics GP, you already have one such tool.

The included Fixed Asset Management Module is integrated to your Dynamics GP financials, providing a centralized asset management database. The Fixed Asset Management module in Microsoft Dynamics GP has many useful features, including complex reporting tools. In this article, we would like to focus on three most beneficial features: the module’s accuracy, easy depreciation, and flexibility.

With the Fixed Asset Management module, you have total control over your data. Make changes, capture necessary asset data fro tax purposes, perform comparisons across multiple assets, or access critical data with a click of a button. Using feedback from thousands of customers from around the world, Microsoft has been improving the fixed Asset Management module for years, making the most commonly used features easily accessible.

Thanks to 16 depreciation methods, you can reliably manage asset depreciation. Dynamics GP allows you to back out depreciation, add additional depreciation, recalculate depreciation, and project your depreciation ahead. Everything is as intuitive as it can possibly be. Just like all Microsoft Dynamics GP modules, the Fixed Asset Management module is flexible enough to empower your business to manage its assets the wait it suits its needs the most. Integrated and Intuitive The Fixed Asset Management module has been designed to integrate well with other Dynamics GP modules, making it incredibly easy to automate complex processes using other parts of Dynamics GP, such as the Purchase Order and Payables Management modules.

Microsoft understands the difference a polished user interface and fine-tuned user experience can make. The intuitive graphical interface of the Fixed Asset Management module is just as approachable as the rest of Dynamics GP, and the integrated contextual help will help you overcome any obstacles that you may come across. These are some of the main reasons why we at have selected Microsoft Dynamics GP as our enterprise resource planning software of choice. We firmly believe that it’s the best ERP software package currently available, and the satisfaction of our clients tells us that we are right. It doesn’t matter whether you own a small start-up or a large, established company—with our help and Microsoft Dynamics GP, you can reach all your objectives with ease.

This one left me scratching my head, so I am up at 2am on a Saturday and thought I would share. Here is the scenario. Customer has a long fiscal year due to a change in their fiscal year. The long year has 14 periods, all years prior and after have 12 periods So we adjusted the Fixed Assets Calendar (Setup-Fixed Assets-Calendar) to have 14 periods for the current year. We also marked the option 'Short/Long Year' and specified 116.67% depreciation (so that the 13th and 14th periods depreciate normally).

All ran great when the client depreciated period 13. It is when we get to period 14 that things seem to go haywire. When we run depreciate on period 14, it backs out the depreciation for period 13.

Creates a complete reversal entry. The only items that depreciate properly are those items placed in service in periods 12, 13, and 14.

Well, wait, it gets better. I can replicate all of this in sample data on GP2015 (the client is on 2013, so wanted to be as close to that version as possible).

So I started wondering what would happen if I backed out the period 14 depreciation. So I did that.

Re-ran depreciation for period 13, and it backed out the incorrect entry. But then if I re-ran depreciation for period 14, it calculates correctly.

Great Plains Asset Management

Simply backing it out and rerunning it appears to fix the problem. Not normal, right? From what I can tell, it has to do with reset life and perhaps the back out process triggers a recalc of sorts.

Because if I pre-emptively run reset life, period 14 will depreciate properly the first time around. I think there is some conflicting info out there about the need to run reset life if you are creating a long year, but you heard it hear first.always run reset life if you alter (even just lengthening) a year in fixed assets. Christina Phillips is a Microsoft Certified Trainer and Dynamics GP Certified Professional. She is a director with BKD Technologies, providing training, support, and project management services to new and existing Microsoft Dynamics customers.

This blog represents her views only, not those of her employer.